Table of Contents

You can achieve the “Saving a Thousand Dollars a Month” goal for unexpected expenses, starting a small business, or retirement if you break it down into small and manageable steps. You might be feeling prioritizing saving over spending is hard and challenging, but it is easy and possible if you set clear goals, strategize your savings, and stick to the plan. It will become your daily saving habit once you start to save for goals. The smart money-saving quote given below by Martin Luther King, Jr. explains it better.

You don’t have to see the whole staircase, just take the first step.

Martin Luther King, Jr.

Why save a thousand dollars a month?

It is a smart move to save a thousand dollars a month for different goals like

- Career goals: Starting a business or learning new skills.

- Relationship goals: Finding a partner or having children.

- Family goals: Planning a family event or spending more time with family.

- Health/fitness goals: Planning to join a gym or a yoga class for health and fitness.

It will provide you peace of mind if you have enough cash in your checking account. Also, saving small amounts every month will help you build the habit of spending less on unwanted expenses and living economically. You can create a stash of cash to build a strong foundation for long-term financial success and gain confidence.

1. Break down the $1,000 saving goal into mini-goals

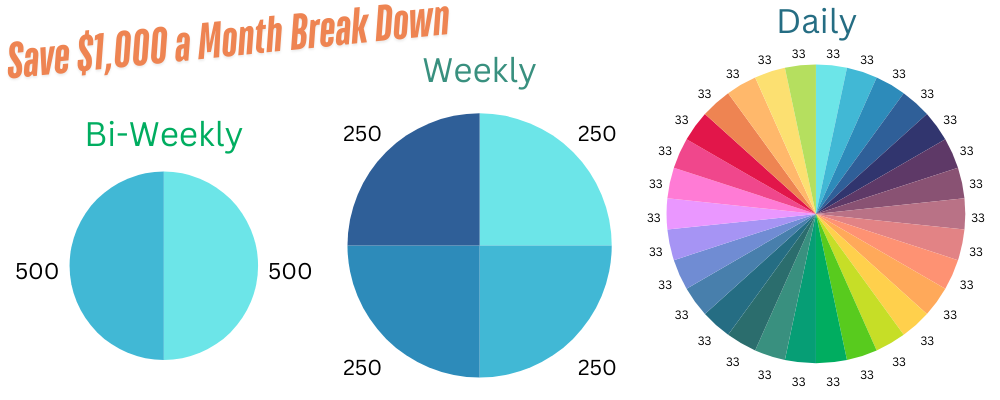

Take pen and paper and divide your monthly saving goal into biweekly, weekly, and daily goals to make it easier and manageable.

- Biweekly saving goal: You will need $500 biweekly to save up a thousand dollars a month.

- Weekly saving goal: There are four weeks in a month, so dividing $1,000 by 4 weeks is around $250 weekly saving.

- Daily saving goal: You will need to add up to around $35.71 per day for a 28-day month, $34.48 for a 29-day month, $33.34 for a 30-day month, and $32.26 for a 31-day month.

Pro tips: Stick. To. Plan. It is very very important to review your daily savings before bed to stay on track. If you spent more today, You can adjust savings on the next day accordingly to stay aligned with your plan. Apply the same rule for weekly and biweekly saving goals as well to confidently save 1k dollars at the end of the month.

Weekly chart to save $1,000 in a month

Here is a weekly saving chart to save a thousand dollars in a month as per the four weeks in a month.

| Week | Contribution per Week | Total Balance |

| One | $250 | $250 |

| Two | $250 | $500 |

| Three | $250 | $750 |

| Four | $250 | $1,000 |

You can prepare daily and biweekly saving charts to track your saving goals and correct discrepancies.

2. Open Dedicated High-Yield Saving Account

It is essential to have a separate savings account to track your daily savings. To earn higher interest, it is advisable to research the security of money and interest rates offered by different financial institutions before opening an account.

From now onwards, you can deposit all your daily and weekly savings in this dedicated account to help save and earn attractive interest on it.

3. Make a Budget to Save Thousand a Month

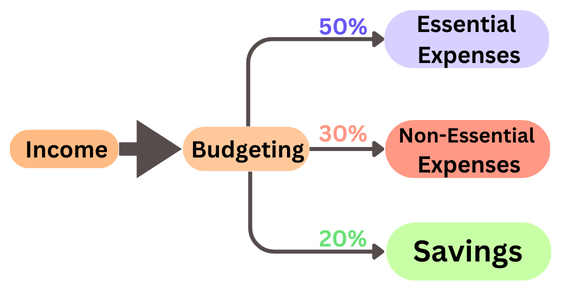

Saving is a part of budgeting, so it is very very important to create a tight budget for maximizing savings. Using budgeting, you can map out the flow of your money, tracking where it comes from and where it goes. It will help you to make sure that you are saving enough after spending on needs and wants expenses.

Steps to create a daily budget for a month

Creating a daily budget will work efficiently to save thousands of dollars a month. Let’s do it for a 30-day month using the 50/30/20 budgeting method.

- Calculate your net total monthly income: Your bank statement will help you to calculate your total monthly income. Add up all your income, including salary, freelancing or side hustle, gifts, and bonuses.

- Divide monthly income by 30: Suppose your total net monthly income is $5,000; dividing it by 30 is $166.66, your daily income.

- Sum up your expenses: Calculate all your essential and non-essential expenses like groceries, shelter, utilities, transportation, entertainment, subscriptions, dining out, and insurance.

- Divide monthly expenses by 30: As per your income, you can spend a maximum of $2,500 on essential expenses and $1,500 on non-essential expenses. The total amount you can spend on both expenses is $4,000; dividing it by 30 will be $133.33 per day. Allocate this amount towards both expenses and try to not spend a single dollar more than the defined amount.

- Pinpoint the areas to cut back: If you are spending more than the budgeted amount on expenses then it is important to reduce your non-essential expenses to allocate funds towards savings. You can reduce your costs on essential items as well if you find any space over there.

- Adjust spending as per need: Suppose you are spending $140 on expenses, which is greater than your daily spending limit of $133.33. Identifies areas to reduce daily spending by $6.67 per day.

- Divert funds towards saving: This is very very crucial part of budgeting if you want to save $1,000 a month. If you don’t divert your funds toward savings, you will likely end up spending it the next day.

- Divide monthly savings by 30: To save $1,000 a month, you need to save $33.33 every day. Divert that fund towards a savings account every day, or you can set up a fund transfer automation from your salary account as well.

Pro tips: You can use other budgeting strategies as well, like envelope budgeting, and zero-based budgeting, or you can use free budgeting apps like Goodbudget or Everydollar to save your effort on budgeting manually.

4. Use the Spend Less, Save More Strategy

To save a thousand dollars a month, you can use the “Spend Less, Save More” strategy, which includes creating a budget, tracking your spending, cutting down your nonessential expenses, limiting impulse buying and dining out, and lowering your utility and transportation costs.

The below-given techniques will help you save 1000 dollars a month and build a cash stash.

Track monthly spending

It is essential to find out cutback areas by identifying where your money goes. You can write down each of your expenses on plain paper or use apps like Mint or YNAB to track your spending and pinpoint unnecessary costs. It will help you identify wasteful habits, improve saving habits, increase awareness, and control expenses. Always keep an eye on your spending to reduce it significantly.

- Example: Suppose you notice you are spending $200 a month on entertainment; that is a good place to cut back. You can plan to spend only $150 on entertainment to save $50 every month. You can reduce your spending on unwanted subscriptions as well to save up for your money goals.

Automate monthly savings

Automating your monthly savings makes it easier to avoid spending from your savings. Plus, it helps you save consistently without having to think about it. You can ask a bank representative to set up automatic monthly transfers to your savings account. The money will be transferred automatically as instructed. It will help you minimize effort, ensure consistency, reduce impulse spending, and encourage saving habits.

- Example: If you are earning $2,000 a month, you can ask your bank to automatically transfer $100 into your savings account every payday.

Find and cut nonessential expenses

Review all your subscriptions, and find and cancel those that you are no longer using. Review and lower your phone and internet plans as per your actual requirements. Cancel unused magazine subscriptions or gym memberships.

- Example: You can cancel your online streaming subscriptions like Netflix and Disney+ to save $20 to $50 every month.

Limit impulse buying

You should avoid or limit impulse purchases like clothes, the latest gadgets, and phones to achieve your monthly saving goal. Apply the “24-hour rule” before buying any non-essential thing. Wait for 24 hours to think if you really need it. If you still want it after a day, go ahead. Always keep a list of necessary items when going grocery shopping or purchasing other essentials. Stick to your list and avoid buying anything extra.

- Example: Suppose you are planning to buy a newly launched gadget that costs $45, but you already have an older version of the same gadget. By avoiding the purchase of the latest version, you can save that $45.

Avoid dining out

Cooking at home is fun! Instead of eating out, try new recipes at home to save money. Preparing meals at home can save a lot of money over time. There are many benefits of cooking at home instead of dining out like, it helps you to enhance your creativity, control over ingredients, reduces waste, creates a comforting experience, and bring your families together with fresh, nutritious, and delicious meals.

- Example: Assume you pay $15 every day on lunch, which adds up to $450/month. You need $7 to $8 per meal, saving $200 to $210 each month. You can save nearly 50% of the cost on your dine-out bill by cooking at home.

Reduce utility bills

You can make small changes in your house, like using LED lights, unplugging devices when not in use, using natural lights and air, etc., to save money on electric bill and increase your monthly savings.

- Example: You can save up to $15 by setting your thermostat a few degrees lower in winter and higher in summer.

Lower transportation costs

Owning a car can be expensive with costs like gas, insurance, and parking. You can find cheaper transportation options, like using the public transportation system, carpooling, or biking instead of driving alone to reduce transportation costs, parking fees, and maintenance costs. Also you can use electric vehicles to reduce transit cost and environmental impact. Always choose walking instead of driving for short distances to save gas and benefit your health by promoting physical activity.

- Example: You can save up to $100 monthly by switching from driving alone to using public transportation or carpooling with a coworker.

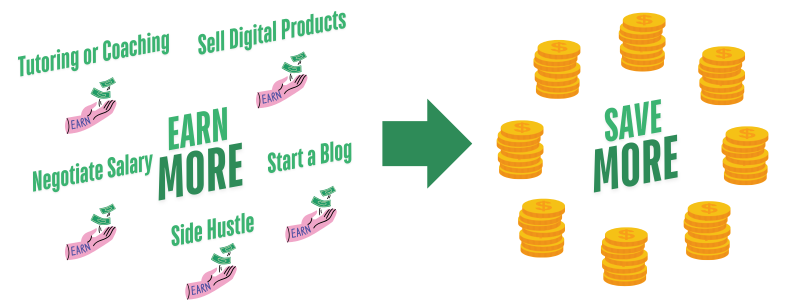

5. Use the Get More, Save More Strategy

You can also use the “Get More, Save More” strategy to save more, which includes increasing your salary, negotiating your bills, keeping your savings in high-interest accounts, taking advantage of employer benefits, and investing in yourself.

Increase Your Income with a Side Hustle

You can use your skills to find side hustle work like writing, selling, or providing services to earn extra dollars and redirect money to savings.

- Example: Suppose you have an excellent skill in article writing; then you can use it to do freelance article writing for others. You can earn up to $50 per article based on your writing skill.

Negotiate Salary for Raise

Talk to your boss and explain how your work has contributed to the company and show your commitment towards work. Also, you can research online to find the average salary level for your role based on your experience and skill so you can request a salary that matches industry standards.

Offer Tutoring or Coaching

You can offer online tutoring or coaching services to students if you have any such skills. There are many online platforms where you can publish online courses and monetize them to earn extra dollars.

- Example: You can prepare and publish an online course on the Udemy educational platform and earn from $8 to $10 per subscription to direct it towards your savings.

Start a Blog or YouTube Channel

Creating and publishing a blog or YouTube channel on your favorite niche is one of the best ways to earn money online. You can share your knowledge with an online audience and earn money by monetizing it using Google AdSense or any other advertising platform.

- Example: Many people are earning hundreds of dollars per month from blogging or running YouTube channels online.

Sell Digital Products

You can sell digital products online like budget planner printables, digital art, email templates, digital audio, or even high-quality photos and videos to earn extra money for saving.

- Example: You can sell photos online at iStock or Shutterstock to earn a cut of the revenue when someone buys your photo for commercial use. This is a very very good idea for passive income if you have a skill in photography.

6. Take on savings challenges

To encourage and motivate yourself, you can take popular savings challenges as mentioned below.

The $5 Challenge: Whenever you get a $5 bill as a change, you set it aside instead of spending it. This is a very easy challenge where you do not need to cut back your expenses.

No-Spend Challenge: This is the best challenge if you have a monthly goal. All you need to do is not spend a single dollar on nonessential items for an entire month. It will significantly boost your balance as you spend only on essential items.

Round-Up Savings: You can join spare change programs through apps by linking your bank account with the app, where every time you make a purchase using your debit card, the amount is rounded up to the nearest dollar. The difference is then transferred to your savings account. Suppose you purchase $12.50. It rounds up to $13.00, saving the extra $0.50.

Envelope System: This is a widely used method to reduce discretionary expenses. In this challenge, you withdraw a certain amount of cash from the bank, divide it, and put it in envelopes labeled for each category. It will assist you to not spend more than the defined amount per envelope.

30-Day Savings Challenge:

On Day 1, set aside a fixed amount, such as $1, and increase it by $1 each day. So, on Day 2, you save $2, on Day 3, $3, and continue it for 30 days. You will add up to $465 after 30 days.

7. Stick to the plan and monitor your progress

It is very very necessary to stick with the plan to achieve financial goals. Consistency is key to success. You can set a defined amount aside every day or week. By recording each deposit or transfer, you can visualize how much you’ve saved and how close you are to your goal. You can use a spreadsheet or app to track spending and savings.

Monitoring your progress is an important part, as you can review your savings regularly and stay motivated. You can maintain focus to achieve your ultimate financial goals.

Is saving $1000 a month too much?

It depends on your individual financial situation, goals, and priorities. If you are earning enough to comfortably cover your living expenses, $1,000 a month is a very good amount, and you can accumulate $12,000 in a year.

How to save $1,000 in 4 weeks

You can save $1,000 in 4 weeks by dividing in mini goals like save $250 every week. Start by creating a budget as per your financial situation, reducing expenses and earning extra, automating savings, avoiding new purchases, and tracking progress.

Can I save $10,000 in 3 months

Yes, you can save $10,000 in 3 months by saving an average of $3,333.34 each month. Break down saving goals into mini goals like saving $111.11 every day or $833.34 weekly. Create a budget and save accordingly by following a strict plan.

- How to Fix the Steam Pending Transaction Issue (Complete Guide) - March 13, 2025

- Flipping Amazon Return Pallets: The Hidden Side Hustle Goldmine - February 28, 2025

- Emerging Investment Opportunities: Where to Put Your Money in 2025 - February 25, 2025

I saved nearly $250 last month by limiting impulse buying and using No-Spend Challenge

That’s great. I hope, you will save more next month by implementing more saving ideas mentioned in above article.

Great article! I can save at least $500 to $600 by using these helpful tips. Thank you very much for sharing such valuable advice.

You are most welcome. Ava..

If I save $500 a month for 5 years how much will I have?

Considering $500 a month, Your total saving will be $6, 000 after one year, $12,000 after two years, $18,000 after three years, $24,000 after 4 years, and $30,000 after 5 years with 0℅ return on saving.

You can accumulate more by investing in High-yield saving account or any other saving instrument like stock, mutual funds, bonds, etc.

Can you please suggest me how much I can make by investing?

Your total invested amount after 5 years will be $30,000.

As per the latest data, the average CAGE return of different asset classes from 1985 to 2024 is below.

US large-cap stocks: +8.6% PA

US small-cap stocks: +7.6% PA

Emerging market stocks: +7.3% PA

International bonds: +2.6% PA

Gold: +2.3% PA

Cash (T-bills): +0.4% PA

Considering the above returns rate PA and investing $500 per month, You can accumulate below given amount after 5 years for different asset classes.

US large-cap stocks: $37,006.40

US small-cap stocks: $36,120.22

Emerging market stocks: $35,858.20

International bonds: $31,975.92

Gold: $31,741.88

Cash (T-bills): $30,296.36

Each asset class has a different risk profile. Please consult your financial advisor before investing in any asset class.

How can I save $5,000 in 100 days?

There are 2 methods you can use to save $5,000 in 100 days as below.

Method 1: 100 envelope challenge

A powerful, realistic, and proven way to save $5,000 in just 100 days is by taking on the 100-envelope challenge! Follow these steps.

Buy 100 envelopes.

Mark them from 1 to 100.

Pick one envelope every day randomly.

Put money into the envelope whatever number is on it.

Repeat process for 100 days.

By the 100th day, you will have saved around $5, 050.

Method 2: Break down 5,000 saving goal in mini-goals

$5, 000/100 days = $50. Save $50/day. Or

$5, 000/14 weeks = $357. Save $357/ week.