Are you struggling to manage your finances effectively? Do you know how to create a budget that works for you? Do you want to take charge of your money and achieve your financial dreams? This guide will show you budgeting strategies and financial planning tips to help you how to create a budget that works for your unique needs.

Creating a budget might seem a little difficult at first, but becoming a budget planner is the key to unlocking financial independence. It will help you to understand where your money is going and eliminate unnecessary expenses, achieve short- and long-term goals, and build financial security. You will have a clear map of where and how much to spend. Everydollar like an app can help you solve your budgeting problems. You can use a 50/30/20 strategy or zero based budgeting strategy as well.

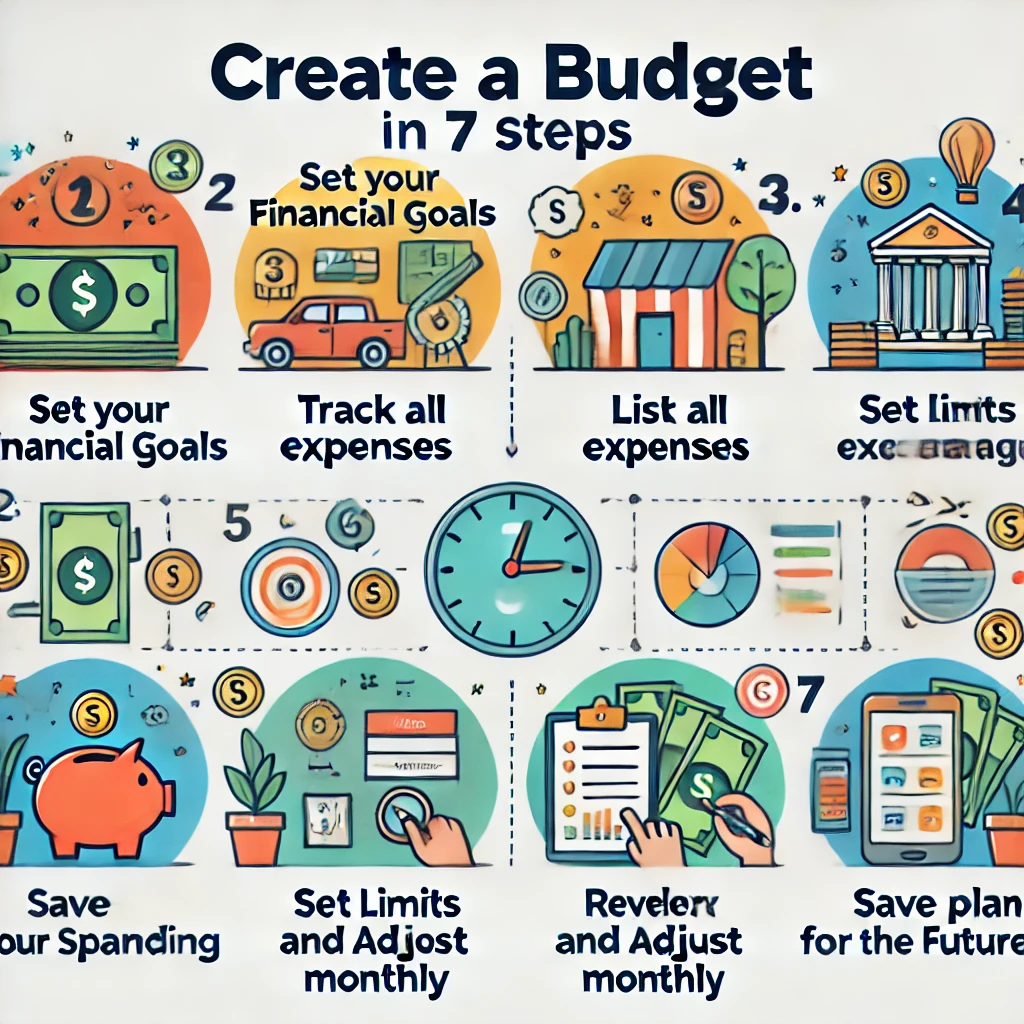

This step-by-step planning and budgeting guide for beginners will take you through the process of building a budget that fits your lifestyle, even if you’re just a beginner.

Table of Contents

Step 1: Calculate Your Total Net Income

It is essential to calculate your net income(which you can actually spend) before preparing the budget. Do you know the difference between net and gross income?

- Gross Income: Total amount you earn before any deduction.

- Net Income: Your take-home amount after all deductions like taxes, Retirement contribution, Insurance, and all other deductions.

- Example: Your monthly salary is $5000 and the total of your deductions is $1500 then your net income is $3500.

Now if you are earning from multiple sources as well then you need to combine all of them.

Example: Your net monthly income from

- Primary source: $3500

- Freelancing: $1200

- Rental property Income: $600

- Side hustle: $250

- Your total net monthly income is $5550.

Identifying your total monthly income is the foundation stone of your budget preparation.

Step 2: Track And Calculate Your Total Expenses

It is a crucial part of budgeting. It can help you get an idea about where your money goes and help you improve your spending habits and save more. The next question is how to track your expenses. You can track your expenses in three different ways.

- Tracking Manually: You can write down your daily expenses in a notebook. This method is time-consuming but still, many people choose this method.

- Digital tool or App: There are many different apps available in the market like PocketGuard, YNAB, Mint, etc. These apps will automatically categorize your transactions.

- Credit card and bank account statements: You can review statements and categorize your monthly spending manually.

There are mainly 2 types of expense categories. Fixed and Variable.

- Fixed Expenses: Mortgage payments or Rent, Utilities Bills, Car or student loan payments, Insurance premiums, etc. These are the expenses that are fixed and predefined.

- Example: You might spend $700 on rent, $450 on utility bills, $300 on loan repayments and $150 on insurance premiums. Your total spending on fixed expense is $1600.

- Variable Expenses: Dining out, Transportation, Groceries, Entertainment, Shopping, Spending on vacation, etc. These are the expenses that can vary every month.

- Example: You spend $300 on dine out, $200 on transportation, $350 on groceries, $300 on entertainment and shopping. Your total spending on variable expense is $1150.

You need to track your expenses, Review them regularly, and adjust them as needed. Based on your review, you can align unnecessary spending with your priorities and build a budget accordingly.

Step 3: Set Realistic Financial Goals

The next step is to set your financial goals which provide you a direction for your budget and manage your money efficiently. Please make sure your goals should be achievable and realistic. Goal setting is very very important because it will provide you direction, motivation, and focus. This is one of the most important point in how to create a budget.

You can categorize your financial goals into four types.

- Short-term Goals(0–3 Years): Saving to purchase new gadgets, pay off a small credit card debt, emergency fund, holiday trip.

- Example: Save $300 for gadget, $800 for debt, $2500 for emergency fund, $800 for holiday trip.

- Medium-term Goals(3-10 Years): Down payment to purchase a home, Build a child’s higher education or wedding fund, Pay student loan, Save Up for a Car, or build a large emergency fund.

- Example: $5000 for down payment, $7000 for higher education, $6000 to pay student loan, $7500 for large emergency fund.

- Long-term Goals(10+ Years): Fund to purchase a retirement home, early retirement or any other Stuff To Save Up For.

- Example: $75000 for retirement home, $100000 for early retirement.

- SMART Goals: Goals that are Specific, Measurable, Achievable, Relevant, and Time-bound (SMART).

- Example: Instead of “save more money,” set a goal like “save $50,000 in 4 years for an emergency fund.”

Step 4: Create Your Budget

This is one of the important step of how to create a budget guide. Now that you have calculated your income and expenses and set your goals. You are all set to create your budget by combining everything. A properly planned budget helps you to control your spending, Increase your savings, and meet all your planned goals on or before the defined time limit.

There are many different ways of creating a budget but the most common and popular methods are below.

- Zero-based budgeting: You must assign every dollar of your income to expenses, debt repayment, and savings. No dollar should left behind after assigning it to all your spending categories as needed.

- Example: If your monthly income is $10000 then assign $2000 for savings or debt repayment, $5000-$6000 for necessary expenses and $2000-$3000 for unnecessary expenses.

- Budget using the 50/30/20 Rule: In the 50/30/20 strategy, You can divide your income into three different spending categories. i.e. 50% for essential expenses, 30% for nonessential expenses, and 20% to pay off debt and savings.

- Example: You can spend $2000 on debt payment or savings, $5000 on essential expenses and $3000 on nonessential expenses out of your $10000 total income.

- Cash Envelop System: You need to label separate envelopes for each category of expenses and put cash in them as per requirement. You need to stop spending on that category once all cash is spent from that envelope.

Out of all the above-mentioned categories, I prefer to use budgeting using the 50/30/20 rule method when anyone ask me about how to create a budget.

Simple Example of a Budget Using the 50/30/20 Rule:

- Monthly Net Income: $5,000

- 50% Essential Expenses:

- $1,500 on Rent

- $300 on utilities

- $450 on Groceries

- $250 on Transportation

- $2,500: Total Essential expenses

- 30% Nonessential Expenses:

- $700 on Dining Out

- $500 on Entertainment

- $300 on Shopping

- $1,500: Total Nonessential expenses

- 20% Savings/Debt:

- $600: Emergency Fund

- $400: Retirement Contribution

- $1000: Total Savings/Debt

This way you can build your monthly budget using the 50/30/20 Rule. You need to take care of prioritizing your essential expenses. Assign enough funds to your essential spending and savings and then the remaining funds you can assign to nonessential spending.

Step 5: Monitor and Adjust Your Budget

Budget can give you an idea about where and how much to spend. But it’s not a static document. You need to review it regularly and adjust it as per the need. By monitoring, you can understand your overspending on unnecessary expenses if any. Overspending on unwanted things means less funds for savings or allocation to essential things.

Review Your Budget at the End of the Monthly

You need to review your budget at the end of every month to understand if you stayed within your limits. By reviewing your budget, You will know if you overspent on unnecessary things and left fewer funds for savings or needs. Based on that, You can take care of it next month

Example: If you overspent by $1,000 on entertainment, then adjust your budget accordingly for the next month by limiting your spending on entertainment or dining out.

Make Adjustments as Needed

Based on your spending, you will be able to identify easily if you spend more than the budget allocation on certain categories. You can make adjustments or change your budget accordingly. Please note that flexibility is the main key to maintaining the budget effectively.

If you find that you consistently overspend in certain categories, adjust your budget accordingly. Flexibility is key to maintaining an effective budget.

Example: If fuel prices rise then your transportation cost will increase. You can not decrease your transportation budget because it is necessary spending. You might need to reduce spending on other categories(i.e. Save Money on Electric Bill) or increase your income from any source to fill that gap.

Revisit Your Goals

Revisit your goals regularly to make sure they remain relevant. Do not compromise on your short-, medium-, and long-term goals by spending more on unnecessary things.

Example: You need $2400 for an emergency fund in a year and allocate $200 per month then stay committed to it.

Step 6: Use Budget Planner Tools and Resources

Budgeting and tracking your finances manually is a little bit boring task. Budgeting tools and resources can help you for more effective personal finance. You do not need to track your income, expenses, and goals manually. Budgeting tools can help you to track your spending, achieve goals, and provide suggestions. Let’s understand how budgeting tools can help you to streamline your financial journey.

Why to Use Planning and Budgeting Tools

You will get visual insights into your financials that make it easier to understand your financial situation. These tools will help you to track from where your money is coming and where it is going. It will alert you if you spend more on unessential things. They can save you time as they track your expenses automatically.

List of Different Types of Budgeting Tools

- Mobile apps like PocketGuard, Mint, EveryDollar can connect with your bank accounts and Provide your financial insights by categorizing your expenses.

- Microsoft Excel or Google budget Spreadsheet for customizable budgeting.

- Many banking apps provide budgeting features with their online banking apps.

Features to Look for in Budgeting Tools

Before using any budgeting tool, You need to look at its features.

- Customization: Check if the tool is customizable as per your needs. Is it allowing you to adjust categories, goals, and different reports?

- Security: Make sure the tool has data encryption and privacy measures especially when it connects with your financial bank accounts.

- Ease of use: The tool or app should be easy to understand and use.

- Automation: Make sure it automates your budgeting tasks like integration with the bank, categorization of transactions, and budget adjustments.

Start Using Budgeting Tools

- Define Goals: Define your goals like building a retirement fund or emergency fund, Paying off debts, or saving for a house.

- Choose The Appropriate Tool: Review your requirements and choose the appropriate budgeting tool.

- Input Your Data: Provide your income, debts, expenses, and goals data to the app.

- Review and Adjust: Regularly check your financial progress, and adjust your budget as needed.

Budgeting apps help you track and manage your financial goals.

Step 7: Stay Committed and Motivated

- You need discipline(For Example: Pay $12000 in debt in 6 months) and motivation to stick with your budget.

- Keep your financial goals(For example: buy a home, or build an emergency fund) in mind to stay focused, committed, and motivated.

- Celebrate your progress(For Example: dine out, or watch a movie) and reward yourself when achieve milestones.

- Keep inspiring yourself by reading success stories, and watching motivational videos.

- Surround yourself with positivity and engage yourself with like-minded people.

- Overcome obstacles and take them as learning opportunities.

- Visualize your success to improve your motivation.

Key Takeaways

You can learn more about how to create a budget by implementing it in your real life. Becoming a budget planner that works for you is about balance, discipline, and flexibility. It’s about building a foundation for your peace of mind and financial freedom. Each step you take to manage your money will step towards your financial freedom.

Everydollar like app can help you in how to create a budget activities. I personally recommend you to use a 50/30/20 strategy or zero based budgeting strategy. By following this beginner’s budgeting guide, you’ll learn how to control your personal finances and move closer to achieving your financial dreams. Start today, and watch your financial growth over time!

FAQs

What is the 50/30/20 budgeting rule?

It is already mentioned in above article with example. You can spend 50% on needs, 30% on wants, and 20% on savings.

Which budgeting app is best for beginners?

You can use Mint or EveryDollar budget planner apps.

How often should I review my budget?

You can review your budget weekly or monthly for better control.

- 5 Personal Finance Mistakes to Avoid in 2025 - January 1, 2025

- Pay Off Debt Faster and Smarter in 9 Easy Steps - December 30, 2024

- 25 Best Way to Save Money in 2025 - December 29, 2024